A council tax hike could be hitting Surrey as members take the first look at the county’s budget. Residents could see a maximum increase of 4.99 per cent on council tax, meaning a rise of £1.69 a week for a Band D household.

The proposed increase, which would come into force from April, was agreed by the cabinet on January 28 and will be voted on at Surrey Council’s budget meeting next week on 4 February.

“I absolutely recognise the pressure that any increase in council tax will put on households,” said Tim Oliver OBE, Surrey County Council leader, at the cabinet meeting. But the leader added increasing council tax was important to “balance our budget and to ensure we can continue to deliver improved and increased services meeting the demand we know we will experience”.

Surrey county council said there is a significant pressure on this year’s budget due to the rising demand for services, like adult social care and children’s home to school transport, combined with inflation and added national insurance contributions- which has resulted in a higher cost of delivery.

Council documents state that for the local authority to balance the books, it has to hike up council tax by the maximum 2.99 per cent, and increase the Adult Social Care Precept by 2 per cent.The final budget for 2025/26 proposes total funding of £1,264.1m, an increase of £55.7m from 2024/25.

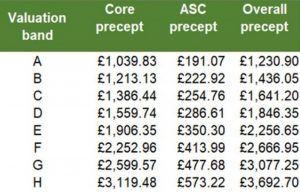

Currently a Band D property pays £1,758.60 a year in council tax, but following the maximum increase in tax, residents could see themselves forking out almost £88 extra. This would bring the total up to £1,846.35 a year. People living in Band H properties could have to cough up £3,692.70 a year for the county council.

This does not take into account other charges in a household’s council tax bill, such as parish precepts, or the police and crime commissioner’s precept. Surrey’s Police and Crime Commissioner (PCC), Lisa Townsend, has heavily indicated she wants the precept to increase by roughly 4.3 per cent. A decision on the PCC’s budget is also due on Monday February 3.

Council reports state the local authority “continues to see exponential increases in demand for services” particularly adult and children’s social care as well as Home to School Travel Assistance. It adds that the demand for these services has resulted in a “need for further efficiencies”, or cuts, within the services and increasing council tax to balance the books.

Draft proposals show the Adult social care budget has been increased by £18.7m and the Children, Families and Lifelong Learning budget (which includes home to school transport) has gone up by £19.2m. However, the county council is also making ‘efficiency savings’ or cuts to the departments, £33m and £12.6m respectively.

The increase in council tax comes after the new government announced a rise in both the National Living Wage and in Employer’s National Insurance Contributions. Not only will this increase the county council’s own wage bill, it may impact its suppliers and potentially lead to increased costs all round. Compensation funding for local councils was not confirmed in the provisional Local Government Financial Settlement, leaving Surrey with some uncertainty.

Speaking to the cabinet, Cllr Oliver said the council has seen “higher levels of inflation than predicted”, an increase in national insurance contributions and national living wage, as well as the cost of borrowing for capital investment has continued to rise as interest rates remain high. The council leader also pointed out the increased demand for services, particularly mental health, and pressures on the health system.

“We have achieved financial stability and we are not in the same position as many other authorities across the country,” said Cllr Oliver. “We have not asked the government for extra financial support and we are not proposing to seek a referendum on increasing our council tax above the permitted 4.99 per cent.”