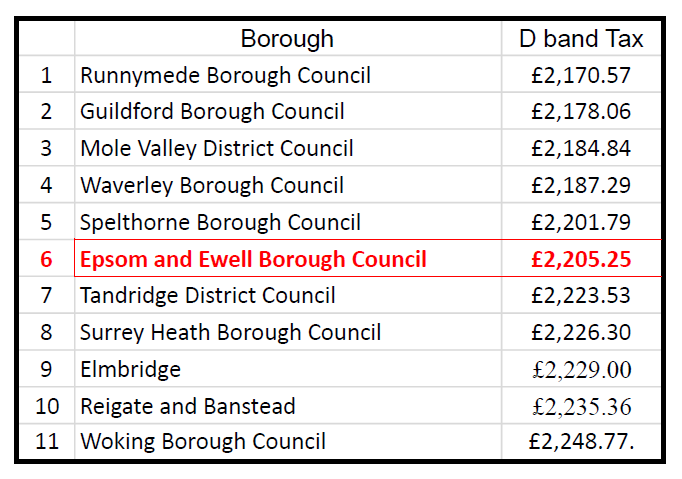

Epsom and Ewell Borough Council is slap in the middle of the 11 Surrey boroughs table of band D council tax charges for 2023/2024. The difference between the highest and lowest is £78.20 per annum. As reported by The Epsom and Ewell Times it should be no surprise to find debt ridden Woking having the highest. Emily Coady-Stemp LDRS reports on the full Surrey County wide picture and Epsom and Ewell Times produces the table.

Related reports:

Budget Report: More council tax for Epsom and Ewell

Epsom and Ewell Council raises tax 2.99%

2023/2024: average of £50 more to pay Surrey County Council

Council tax bills for Surrey residents will go up from April 1 after authorities confirmed their budgets for the coming financial year. Surrey County Council, the Police and Crime Commissioner, and each of the county’s 11 districts and boroughs, confirmed their increases separately last month, with council tax bills and collection being the responsibility of the districts and boroughs.

The Police and Crime Commissioner, Lisa Townsend, confirmed a rise of £15 per year for residents amid an increase in Surrey Police’s fuel bills of more than £500,000.

While Surrey County Council, which is responsible for adult social care as well as services including road repairs and schools, increased its share by £50 per year on Band D homes.

See below for a breakdown of the council tax bands in your area.

Elmbridge Borough Council

The average Band D property in Elmbridge will pay £2,229.00, except in the Claygate parish, where the bill for a Band D home will be £2,243.15.

Band A: £1,486.00

Band B: £1,733.66

Band C: £1,981.33

Band D: £2,229.00

Band E: £2,724.34

Band F: £3.219.67

Band G: £3,715.00

Band H: £4,458.00

Epsom and Ewell Borough Council

Residents in Surrey’s smallest borough will see council tax bills of £2205.25 from April, for the average Band D property.

Band A: £1,470.17

Band B: £1,715.19

Band C: £1,960.22

Band D: £2,205.25

Band E: £2,695.31

Band F: £3,185.36

Band G: £3,675.42

Band H: £4,410.50

Guildford Borough Council

The bill for Band D households in Guildford will be £2178.06, excluding parish and town councils. For Band D the parish share ranges from no extra charge in Wisley to £2291.71 for a Band D property in Normandy.

Band A: £1,452.04

Band B: £1,694.04

Band C: £1,936.05

Band D: £2,178.06

Band E: £2,662.07

Band F: £3,146.08

Band G: £3,630.1

Band H: £4,356.11

Mole Valley District Council

In Mole Valley, the average Band D property will pay £2,184.84, except where there are parish councils. In Charlwood, with the highest parish council precept, residents in a Band D property will pay £2,259.09.

Band A: £1456.56

Band B: £1699.32

Band C: £1,942.08

Band D: £2,184.84

Band E: £2,670.36

Band F: £3,155.88

Band G: £3,641.4

Band H: £4,369.68

Reigate and Banstead Borough Council

A Band D home in Reigate and Banstead will pay £2,235.36 from April, while residents in the Horley Town Council Area will pay £2,283.12 and in Salfords and Sidlow will pay £2,265.08.

Band A: £1,490.24

Band B: £1,738.61

Band C: £1,986.98

Band D: £2,235.36

Band E: £2,732.11

Band F: £3,228.85

Band G: £3,725.60

Band H: £4,470.72

Runnymede Borough Council

Runnymede residents in Band D property will pay £2,170.57.

Band A: £1,447.05

Band B: £1,688.22

Band C: £1,929.39

Band D: £2,170.57

Band E: £2,652.92

Band F: £3,135.27

Band G: £3,617.62

Band H: £4,341.14

Spelthorne Borough Council

Residents in a Band D property will pay £2,201.79 for their council tax in Spelthorne.

Band A: £1,467.86

Band B: £1,712.50

Band C: £1,957.14

Band D: £2,201.79

Band E: £2,691.08

Band F: £3,180.36

Band G: £3,669.65

Band H: £4,403.58

Surrey Heath Borough Council

Surrey Heath’s amount for a Band D property is £2226.30, plus the amounts paid to parish councils throughout the borough. Bands listed below are for the most expensive parish, in Bisley.

Band A: £1,523.45

Band B: £1,777.35

Band C: £2,031.26

Band D: £2,285.17

Band E: £2,792.99

Band F: £3,300.8

Band G: £3,808.62

Band H: £4,570.6

Tandridge District Council

In Tandridge, a Band D property’s council tax will be £2,223.53 2023/24. Parishes in the district range from no additional charge, to £2,311.97 in the most expensive, Crowhurst.

Band A: £1,482.36

Band B: £1,729.41

Band C: £1,976.47

Band D: £2,223.53

Band E: £2,717.65

Band F: £3,211.76

Band G: £3,705.89

Band H: £4,447.06

Waverley Borough Council

A Band D home, excluding parish council charges, is set at £2,187.29 in Waverley. The most expensive parish bills are in Godalming, and shown below.

Band A: £1,530.45

Band B: £1,785.52

Band C: £2,040.60

Band D: £2,295.67

Band E: £2,805.82

Band F: £3,315.97

Band G: £3,826.12

Band H: £4,591.34

Woking Borough Council

In Woking, residents in a Band D home will pay £2,248.77.

Band A: £1,499.18

Band B: £1,749.04

Band C: £1,998.90

Band D: £2,248.77

Band E: £2,748.50

Band F: £3,248.22

Band G: £3,747.95

Band H: £4,497.54