Finding temporary accommodation for families at risk of homelessness is the “biggest financial pressure” facing Epsom and Ewell.

Following Epsom and Ewell Times report 13th October 2023 on Epsom and Ewell Council’s 10th October 2023 meeting of the Community and Well-being Committee: “Council Grapples with Rising Cost of Homelessness“, Emily Dalton probes further after this year’s meeting 8th October 2024.

Our local Council (EEBC) provides around temporary units to 250 households, according to data from July 2024. Of those, 90 are nightly accommodations.

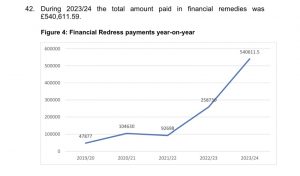

The council spent £1,665,493 on nightly emergency accommodation in 12 months to April – an overspend of £395,000. EEBC had originally budgeted for 70 families in nightly paid accommodation but throughout the first five months of 2024, the Council was regularly supporting in excess of 90.

“The situation remains significantly serious and will be for some time to come,” said Councillor Clive Woodbridge, speaking at a Community and Wellbeing meeting on October 8. Despite hard-working officers behind the scenes, council documents stated that it is unlikely the number of homeless families will decrease over the next 12 months.

EEBC is absorbing the costs through its original budget, a homelessness grant reserve and the council’s general fund balance and contingency. Nearly £650k has been awarded to EEBC as part of a Homelessness Prevention Grant for this financial year 2024/25. But, officers warned that if demand remains exceptionally high, the local authority may have to dip into its reserves.

Homelessness “affects all households of all sizes”, a EEBC officer told the committee. He added: “But particularly for us, the higher expenditure is around family-sized households.” Overcrowded and multi-generation families, rather than rough sleeping was presented as the most prominent issue coming before the council, the officer said.

Due to demand for accommodation, officers are on occasion having to use economy hotel rooms when no other accommodation is available. The total cost for this can be around £140 per night.

Officers explained the council has a legal “duty” to help people at risk of homelessness and so will continue to foot the bill for temporary accommodation despite the budget pressures.

Landlords were encouraged to take on more council tenants at a landlord forum run by EEBC on September 26. The council is looking for landlords of three, four and five-bedroom houses to sign up to its private sector leasing scheme, so it can reduce the amount it spends on the nightly units. EEBC also highlighted the ‘Rent Deposit Scheme’ as a preventative homeless measures where councils support tenants with deposits and guarantees.

Looking for new ways to solve the problem, EEBC has asked landlords to help provide emergency housing for families and individuals at risk of homelessness. Although the event was reportedly “well attended”, council officers said it may be “slow burn” for landlords to come forward for the scheme. Officers said there were a couple of approaches but “nothing concrete yet”.

Related reports:

Epsom and Ewell Press Release on Homelessness

Council Grapples with Rising Cost of Homelessness

Image: Evelyn Simak cc-by-sa/2.0