Relative relief about Epsom and Ewell’s debt?

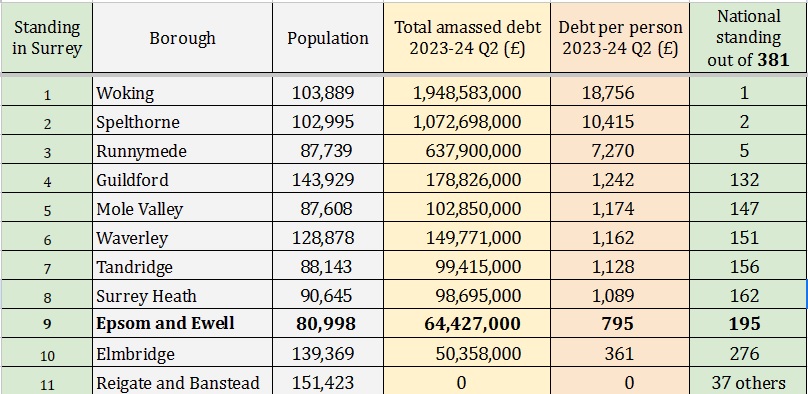

Epsom and Ewell Borough Council‘s debt is about average with all 381 United Kingdom local authorities. UK councils owe a combined £97.8bn to lenders, equivalent to £1,455 per resident, as of September 2023. Epsom and Ewell’s debt per person is £795. From highest debt per person to lowest Epsom and Ewell ranks 195 out of 381.

In the national league table of debt shame other Surrey Boroughs occupy the leading positions: Woking is first with debt of £18,756 per resident followed by Spelthorne in second place at £10,415. Guildford is 5th.

Taking into account all types of local authorities, such as police and crime commissioners and combined authorities, the debt pile rises to £122bn.

The 11 boroughs of Surrey are ranked in the table below. Highest debt per resident to lowest.

Dame Meg Hillier, the chair of the House of Commons Public Accounts Committee, said some examples of debt were “staggering”.

But council leaders say years of under-funding mean they have been forced to take out loans and invest in commercial properties just to keep services running.

In recent years, various commentators have warned that the debts held by councils – which must balance their budgets every year – are unsustainable. In 2020, chair of the Public Accounts Committee Dame Meg Hillier said the Government was “blind to the extreme risks” of council borrowing levels.

Since then, six more councils have had to issue section 114 notices declaring themselves effectively bankrupt: Croydon, Slough, Thurrock, Birmingham, Woking and Nottingham.

In the case of Croydon, Slough, Thurrock, Woking and Nottingham – those effective bankruptcies could be directly linked to failed investments and spiralling debts. Thurrock’s £469m funding black hole, for example, was caused by a series of failed investments in solar farms.

Dame Hillier added: “Small district councils have very little room for manoeuvre when finances are squeezed, relying on charges (such as parking fees) for a lot of their income. Unitary authorities are facing the demographic pressures on social services, social care and special educational needs.

“But beyond these day to day pressures, the PAC warned in 2020 that some councils had not only pursued strategies of commercial investment exposing them to high levels of risk, but normalised behaviour and optimistically believed that there was little downside to commercial activity. Add to this the delay in public sector audits and many councillors and taxpayers were blind to the risk.”

Cllr Julie Morris, (College Ward) Leader of the Liberal Democrat Group on Epsom and Ewell Borough Council said “There is no evidence that central government is likely to assist with the broader financial issues affecting local authorities, so we need to budget carefully and 2025/26 is likely to be crunch time. We need a complete review of both mandatory services and those which are discretionary. And central government needs to wake up to what is facing government at local level.”

Cllr Neil Dallen, (RA Town) Chair of Strategy & Resources Committee said: “As a council, Epsom & Ewell’s investments are performing as planned. The debts are considered sustainable, with sums set aside each year to ensure they can be repaid at maturity. Through taking a proactive approach to our finances, we have a strong track record of meeting the considerable financial challenges the past decade has brought for local government through reduced central government funding, and we are looking ahead to 2024/25 and beyond to ensure that we remain a financially sustainable council.”

The other parties have also been invited to comment.