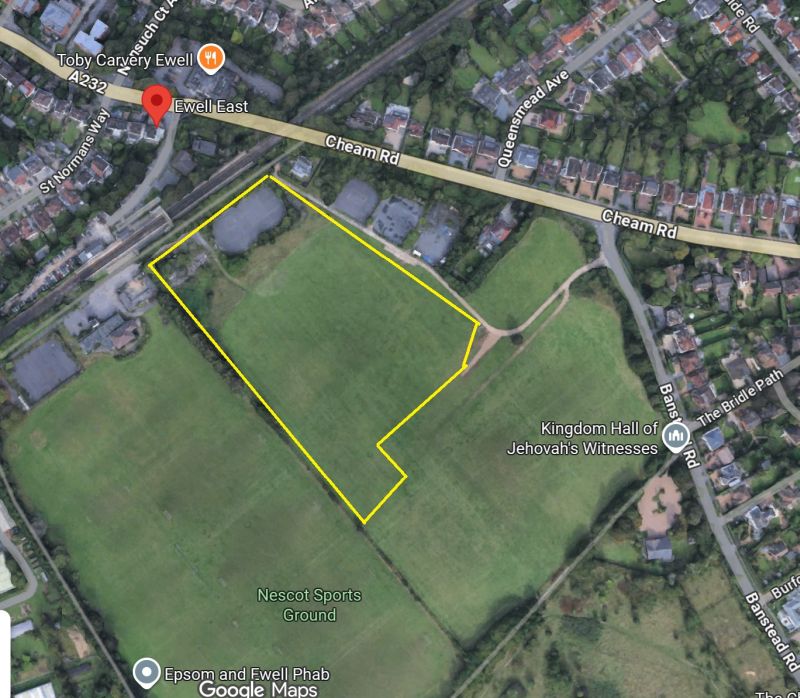

Epsom and Ewell one of the most expensive places to own a home in the UK

Residents in Epsom and Ewell could be spending the equivalent of more than four-fifths of a single average salary on mortgage repayments, according to a new affordability analysis published by property buying firm Sell House Fast. The study ranks Epsom and Ewell fourth among UK areas outside London for the proportion of “net annual pay” it estimates would be taken up by annual mortgage repayments, putting the figure at 82.2%.

The analysis combines earnings data from the Office for National Statistics (ONS) Annual Survey of Hours and Earnings with local average house prices from the UK House Price Index. It then models mortgage repayment costs by assuming a 20 per cent deposit and applying the Bank of England base rate. On that basis, Sell House Fast lists Epsom and Ewell with a median annual net pay of £35,380, an average house price of £560,957, and estimated annual mortgage repayments of £29,083.

Official figures suggest the house-price element of the estimate is broadly consistent with published data. ONS housing statistics show the average house price in Epsom and Ewell was around £556,000 in October 2025 (provisional), rising to about £570,000 for homes bought with a mortgage.

Housing analysts caution, however, that figures of this kind are highly sensitive to assumptions. The analysis does not describe what existing homeowners in Epsom and Ewell actually pay each month, but instead models repayments using a fixed deposit level and an interest-rate assumption that may not reflect the mortgage products many households are on, particularly those who secured fixed-rate deals in earlier years. The Bank of England base rate has also changed several times over the past year, which can significantly affect illustrative repayment calculations.

It is also important to note that the comparison is based on the average net salary of a single individual. In practice, many mortgages in Epsom and Ewell are taken out jointly, with repayments shared between two wage earners, which can substantially alter affordability at the household level.

Even with these caveats, the analysis adds to wider evidence that Epsom and Ewell remains one of the least affordable areas in the South East when local incomes are set against local house prices, underlining the continued pressure faced by first-time buyers and households seeking to move within the borough.

Image: An Epsom Street – Google Maps