Epsom and Ewell Borough Council met for two hours Tuesday 13th February to debate the proposed budget and Council tax increase for 2024/2025. Councillors received a 288 page report containing all the facts and figures. All the recommendations were approved.

It boils down to this:

A. Epsom and Ewell’s share of Council Tax goes up the equivalent of 2.99% – the maximum the law allows. (£6.57 for a Band D property – the most populous in the Borough).

B. Councillors’ basic allowance goes up 50%, from £4031.70 to £6081.11. Chairs and Vice-chairs of committees get additional allowances ranging from 30% to 100% of the basic members’ allowance.

C. Council staff salaries will increase 6%.

Reacting to the budget, leader of the Labour Group Cllr. Kate Chinn (Court Ward) said: “I’m sure the residents of Epsom and Ewell will have noted the residents’ association are putting up council tax, part of which will pay for the huge pay rise they voted through for themselves last night. However, the cost of the pay rise is relatively small when compared to the huge amounts spent on temporary housing for homeless people due to this council’s abject failure to build social housing.”

During the debate she said: “When we look at the staff for the council getting a 6% pay rise and having had raises very much less than inflation over the last five, six, seven, maybe even longer more years, I feel very uncomfortable awarding myself this large pay rise. It doesn’t seem right. It doesn’t sit comfortably with my values.”

Cllr John Beckett (RA Auriol) said: “Our staff get an annual pay review. Reading through this report, councillors have not taken an increase in their allowance for the past 10 years. So whereas our staff have been getting a regular review, it may well not hit the rate of inflation, they have been getting an increase. We as councillors have not. So unfortunately, whether Councillor Chinn accepts the point, the reason for such a large increase is to catch up with the choices that this Council has made not to accept that remuneration in the past.”

Cllr Neil Dallen (RA Town Ward) proposed the 2.99% increase in EEBC’s Council Tax and said in a wide ranging speech: “The current government has been less than helpful in creating stability and allowing good financial forecasting”. After noting several changes of top Council officers he said: “It’s not often you see so much change in a senior management team in such a short time. Everyone is going to need time and space to readjust, learn to work effectively and efficiently together to bring both stability to the council and its workforce, and to have the confidence to introduce changes and take the best advantage of opportunities that arise.”

On the budget he remarked: “Government has also capped for many years the increase in council tax, which traditionally had been the way to meet increased costs. We have had to use reserves to balance the budget over the last few years, and reserves don’t last forever. We still have a small budget gap and are forecasting the use of reserves to fill that gap, but we’re also taking steps to increase revenue as well as making savings.”

On homelessness he said: “Without adequate funding, we cannot achieve what we set out to do, and homelessness will continue to rise. A particularly worrying trend is the increase in young people who find themselves homeless. If the government is serious about reducing homelessness, they need to fund local authorities to enable them to achieve this.”

For the LibDems Cllr Alison Kelly (Stamford) touched on a wide variety of topics: “Why has a rewrite of the rules for spending the community infrastructure levy funds money meant that we’ve had to cancel a 12-month period for spending any of it? Sadly, to an outside observer, the answer seems to be that we can’t spend any money as we need the interest to fund the general services. This is not sustainable in avoiding the filing of notice of bankruptcy as has happened elsewhere.” She added: “Many councils are in danger of bankruptcy, and recent league tables show that we are mid-table with nearly £800 of debt per person. The Resident Association plan to resolve this seems to be the anticipated £500,000 increase in revenue from car parks, aspiration at best and a fantasy at worst, as this comes even though we expect to be nearly £200,000 down on last year’s budgeted income.”

She used the opportunity once more to have a go at Council secrecy: “Our Council group feels there are some unfathomable instances of resorting to allegedly legally privileged information which is then weaponized to keep an entire topic secret. There is no secret about needing to review the sites available to developers as part of the local plan, and there would be almost nil cost in keeping the public abreast of how the in-house meetings on this topic are progressing.”

For Labour Cllr Chris Ames (Court Ward) said: “I understand it’s regularly alleged at these times that Labour doesn’t understand the need to find more money to meet the needs of residents. We absolutely do, but we don’t think it should be done by transferring budget pressures to the people we are elected to serve. The cost of living crisis hasn’t gone away just because the current inflation figures have fallen. Not only is the current 4 or 5% still far too high, it means that over the last year, prices rose over and above where they were after a period of double-digit inflation.

We still have large numbers of residents unable to feed their families or relying on food banks to do so. We still have residents who lie awake at night wondering how they’re going to pay their bills, their rents, or mortgages.”

Cllr Kieran Persand (Conservative Horton) said: “Financial mismanagement has serious consequences, which we have witnessed on multiple occasions in recent times. However, we should err on the side of caution. We’re introducing measures which may prove to be counterproductive.

As stated in the report, the major challenge is the delivery of the £1.4 million of additional income and savings and finding a further 0.5 million reduction in council’s net exponential by 2027/28. However, the council has acquired a number of commercial properties both within and outside the borough through borrowing. As of the end of 2022/23, the council’s external debt totalled £64.4 million, and the interest paid to service this debt was £1.6 million last year. We’re still facing economic uncertainty. Should we really be taking or amassing more borrowing debts in this current climate?”

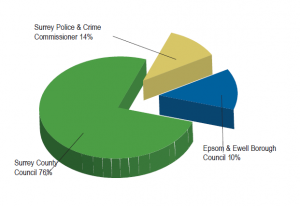

Here are some graphics from the report that may put some matters in perspective:

The Council continues to benefit from its property investments and car parking income to maintain its finances in relative good order compared with other Boroughs in Surrey. Several of which face serious financial challenges: E.g., : Woking, Guildford and Spelthorne.

For 2023/2024 Epsom and Ewell’s share of Council tax was third lowest in the County.

Related reports:

“Audit and Scrutiny” under scrutiny

A question of pay for Epsom and Ewell Borough Council

Surrey’s debts match Woking’s but its position is secure?

Relative relief about Epsom and Ewell’s debt?