Accountants shortage blamed for Surrey’s rising debts

The scale of the financial problems unearthed by initial forensic exams of Woking Borough Council’s left many shocked. The council’s accounts had not been signed off by an independent auditor for more five years as part of a national shortage of qualified accountants that has left a high backlog across local government bodies.

Meanwhile, the borough’s chief financial officer warned things could get worse as they uncover more.

On June 23, the Public Accounts Committee said that delays to publishing audited accounts increases the risk of governance or financial issues being identified too late, and hinders accountability for £100billion in local government spending, with knock-on impacts for central government and the NHS.

It led to the committee’s deputy chairperson asking “how many more horror stories such as Croydon, Slough, Thurrock, and more recently the shocking case of Woking council are there remaining undetected?”

Following the report, the LDRS looked at three other Surrey councils with either high levels of borrowing, or that had experienced recent write-downs in the value of their assets and asked if residents can be confident their councils won’t go bust too.

Woking Borough Council – £1.7bn estimated debt in 2022, expected to rise to £2bn. There has also been an “absence of external audit opinions on the council’s accounts” since 2018/19. The majority of the council’s debt was built on complicated development deals. It borrowed hundreds of millions to pay companies it owned for town centre regeneration projects. It also funded its own loss-making businesses. Like many council’s Woking’s central funding fell significantly over the past decade.

According to the National Audit Office its Government-funded spending power dropped 69.2 per cent in the past decade. To counter this, it embarked on an investment strategy to cover the deficit, regenerate its town centres, and maintain non-statutory services.

In 2019/2020, the council received £6.7m from the Government, £9.9m from council tax and £28.7m from its investments.

The problem was that it spent £17.7m on services, £6m on minimum revenue provision, and £33.1m just on the interest on its debts.

The Public Audits Committee published the “Timeliness of local auditor reporting” on June 23, three weeks after Woking Borough Council issued its section 114 notice declaring it could no longer balance its books.

Chairperson, Dame Meg Hillier MP, said: “Our Committee warned in 2021 that the system of local government audit was close to breaking point. Disappointingly, since then the situation has only gotten worse. The cases of Croydon, Slough, Thurrock and Woking councils all should serve as flashing red signals for the Government, and our report finds that the rot risks spreading to central government finance and the NHS.

Deputy chairperson Sir Geoffrey Clifton-Brown MP,said: “How many more horror stories such as Croydon, Slough, Thurrock, and more recently the shocking case of Woking council are there remaining undetected, which ultimately always have to be bailed out at huge costs to the taxpayer? The fragility of the number of qualified people and firms tending to carry out these important audits means that the system will only get worse before it gets better.”

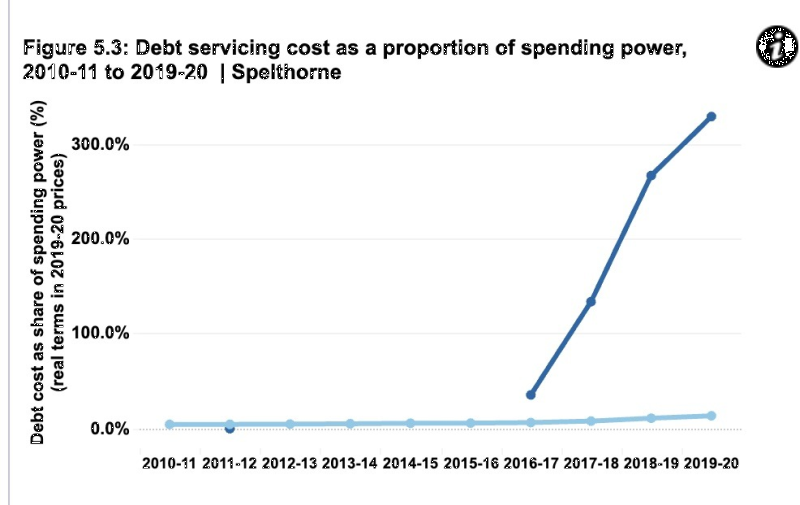

Spelthorne Borough Council – £1bn debt as of 2022, last set of audited accounts signed off: 2017/18. In 2022, there were nine local authorities with borrowing of more than £1bn.

They were either major population centres, Transport for London, Birmingham, Greater London Authority, Leeds, Warrington, Edinburgh, and South Lanarkshire, or bankrupt; Woking.

The other is Spelthorne Borough Council, with a debt of £1,084,655.00 and a capital programme under review from central government. Last week, it emerged that £50m development plans for Thameside House has now jumped to £80m – mirroring, albeit on a smaller scale, Woking’s Victoria Square development originally budgeted to cost £150m but now stands at £750m and a book value of around half that.

Since 2010, Spelthorne’s Government funded spending power has fallen 66.3 per cent creating the same environment of needing to find alternative funding or reduce services. The council borrowed £1bn over a three-year period from the Public Works Loans Board and income from its investments brought in £55.3m in 2019/20 – out of a total of £72.8m. That allows the council to spend £16m on services while paying off £24.2m in interest payments with £11.1m set aside to pay off the principle.

The sustainability of the strategy is less obvious with the council’s debt servicing as a proportion of spending power climbing to 328.1 per cent, higher than even Woking’s 295.2 per cent for the same 2019/20 year. A spokesperson for Spelthorne Borough Council said: “The financial situation is significantly different between Spelthorne and Woking Borough Council. Spelthorne has taken steps to ensure that the commercial property programme is sustainable, and our investment model is very different. We have always taken a cautious approach, paying down debt on a year-by-year basis (like a mortgage) and ensured that the council has fully complied with the CIPFA requirements for Minimum Revenue Provision. The council took a long-term strategic view to acquire key investment and regeneration properties in order to generate income to support and fund council services, affordable housing, and regenerations programmes.

“We save up funds over a long-term time frame and have set aside £37.8m sinking fund to cover potential dips in income. Spelthorne Council has the highest ratio of usable reserves to net revenue budget of any district or borough council in the country.”

Runnymede Borough Council: £600m debt as of 2022, last set of audited accounts: 2018/19

Runnymede Borough Council is awaiting the findings of a Department of Levelling Up, Housing and Committees report into its finances and its strategy to borrow heavily for town centre redevelopment projects.

It is another council that followed the investment/redevelopment route, in part to cover the 55.5 per cent decrease in its Government-funded spending power. High profile developments such as Addlestone One and the Egham Town Centre have changed their local areas with new shopping centres, hotels and cinemas. But they have also resulted in the council’s debt servicing costs climbing to 168.9 per cent, about half of the levels in Woking or Spelthorne but still way above the national average of 13.4 per cent for local authorities.

The investments brought in £28.1m in 2019/20, from a total of £40.8m in income, which covers the borough’s £13.4m spending on service as well as its £11.1m in interest repayments and £3.2 for the principal.

A spokesperson for Runnymede Borough Council said it “only undertakes borrowing where it is prudent and affordable. Our current capital programme, approved in February 2023, does not include any new major schemes that require additional borrowing. We have a robust policy covering the repayment of debt, which is reviewed annually as part of the budget process and is included in all the council’s financial plans. We continue to set a balanced budget and to hold sufficient reserves to manage known risks alongside contingency for unforeseen events.

“The local government sector is suffering from the effects of the backlog in the audit profession. The Council is still awaiting final sign off for its 2019/20 accounts. “Since 2010 there have been significant cutbacks to local government funding. We calculate the loss of revenue support grant to be in excess of £5million, which equates to a third of our net budget. This has been partially offset by other grants, but only modestly. To protect services, we have had to raise our own sources of income whilst making efficiencies.”

Surrey Heath Borough Council: £51m debt at 2022, last set of audited accounts 2018/19. Debt levels in 2022 stood at £51m, putting Surrey Heath Borough Council in a different position compared with Woking, Spelthorne and Runnymede. However, it has since emerged in unaudited accounts that its debt grew to £160m and its biggest asset dropped by £79m. This prompted the council to announce it was updating its property acquisition strategy despite its government-supported funding dropping by 60 per cent in the last decade.

This change in approach is taking place even though its 2019/20 debt servicing levels were comparatively low among Surrey peers at 41.8 per cent – although its debt levels have since climbed. The council balanced its books in a more conventional manner with just £3.3m of its £15.5m income coming from its investments that year. This covered the £9.96m to run its services, with £2.3m paid in interest and £2.2m set aside to pay off the debt.

A spokesperson for Surrey Heath Borough Council it was considered to have a “sound strategy for debt management as per the annual Treasury Strategy agreed at Council in February. We are not interlinked with Woking Council and therefore it is considered that no changes are required. The Medium Term Financial Strategy approved at February council contains a minimum revenue provision for future debt repayment. This has been calculated in accordance with central government and CIPFA guidance.

They added: “The council no longer receives any revenue support grant from central Government. The council retains business rate income, but also has to pay a tariff on this to central government. It is difficult to put a £ and % figure on this as the real term reduction is a great deal higher than the actual cash reduction.”

The committee report concluded that the backlog of audit opinions for local government bodies remains unacceptably high, and that there is still no plan to reduce it.

Only 12 per cent of local government bodies received their audit opinions in time to publish accounts for 2021–22 within the already extended local authority accounts publication deadline.