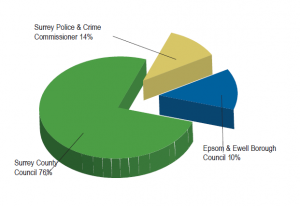

Epsom and Ewell’s Council tax is to be increased by 2.99% for 2023/2024. At a meeting of the Full Council last night the budget for 2023/2024 was approved.

Chair of the Strategy and Resources Committee, Cllr Neil Dallen (RA Town Ward) proposed the budget with a wide-ranging speech. The Residents’ Association led Borough Council was succeeding in balancing the budget despite many challenges. He made a number of points including:

- The Government’s “disastrous mini-budget” of September 2022 that led to increases in interest rates.

- The increase in home-working of Council staff arising from Co-Vid.

- The frequency of resignations of senior staff.

- The “meddling” of Surrey County Council. The failure to consult over the abolition of Local Committees (a forum that brought County and Borough representatives together), the decisions to bring back to County parking enforcement and verge cutting etc.

- The invasion of Ukraine and increase in energy bills.

- Negative rate support grant – meaning Epsom and Ewell Council pays central Government not the other way around.

- The lack of Surrey police resources to patrol Epsom and Ewell.

- The challenge of homelessness “over which we have no control”.

- The unqualified audit acceptance of the last budget.

- The success of the Council owned Epsom Playhouse’s pantomime season.

- The success of the Council’s recycling programmes.

- The Council’s support for Epsom’s Business Improvement District company.

- The work done in bringing the draft Local Plan to its consultation stage.

He explained: “The council would be spending £29.5million in the coming year, with £7.4m of the borough’s £28.8m income coming from council tax.

He said that the Council was now entering a phase of stability and he referred to the preceding item on the meeting’s agenda that approved the permanent appointment of Jackie King as Chief Executive Officer of the Council. On that earlier item there was some controversy when Cllr Debbie Monskfield (Labour – Court Ward) asked how Councillors could vote to approve a new pay scale when the figures were not apparent? It was stated that senior staff, including the new CEO, were to get pay rises up to possibly 17% compared with the 3% for other staff. The new pay rates were nevertheless approved.

In reply to the budget speech Leader of the Opposition Cllr Kate Chinn (Labour – Court Ward) opposed an increase in Council Tax at this time of crisis for the many who have to “choose between heating or eating.” “Residents who lie awake at night wondering how they can possibly pay their bills, their rents or mortgage and their increased council tax.” She accused the ruling RA Group of “Wanting to keep their precious venues forever the same. Bourne Hall must provide the most subsidised Zumba classes in the country.”

She suggested there were other ways to raise revenue and save money. Community driven litter picking with free skips reducing the expense of dealing with fly-tipping. Not to provide free pre-Christmas parking again. The amalgamation of backroom services with other Councils. Reducing homelessness.

Later Cllr Eber Kington (RA Ewell Court) fired back at Labour stating that years in a row Labour had objected to increases in Council tax and if they had had their way cumulatively the losses would be millions. Jan Mason (RA Ruxley) chipped in “Who would want to live in Croydon where isn’t it Labour who have ruled it for ages and their taxes are increasing by how much?”

Cllr David Gulland (Lib Dem – College) said that he supported the increase in Council Tax but would vote against the budget as it failed to address two significant failures of the Residents’ Association led Council. Firstly, the failure to adequately address the nuisance going on at the Chalk Pit waste site. Was Epsom to become “skip-city”? he asked. Secondly, the failure to inform Councillors of the adverse findings of both the Local Government Ombudsman and the Information Commissioner in relation to the complaints of a resident. He didn’t like the overall direction of the RA.

23 Residents’ Association Councillors voted in favour of the budget and increase in Epsom and Ewell’s Council tax. The 3 Labour and 2 Liberal Democrat councillors voted against and there was one abstention. The single Conservative Councillor, Bernie Muir, (Stamford Ward) was not present.

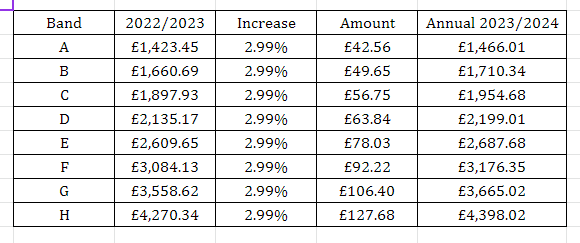

Epsom and Ewell’s Council Tax Bands are as follows:

Related reports:

Surrey County Council sets 23/24 budget

Surrey County Council proposes 2023/24 budget

Senior local Councillor slams Surrey’s budget consultation

Budget Report: More council tax for Epsom and Ewell re 2022/2023 budget