Surrey County Council proposes 2023/24 budget

Surrey County Council is planning to restrict a rise in Council Tax to 2.99% in the current budget plans for 2023/24. The council’s Cabinet agreed the draft budget today outlining the planned rise, which is lower than the vast majority of other councils in the UK and far lower than the rate of inflation.

Surrey County Council spends just over £1bn a year on delivering vital services such as Adult Social Care, Children’s Services, maintaining roads and pavements, Surrey Fire & Rescue Service, libraries, countryside management and public health.

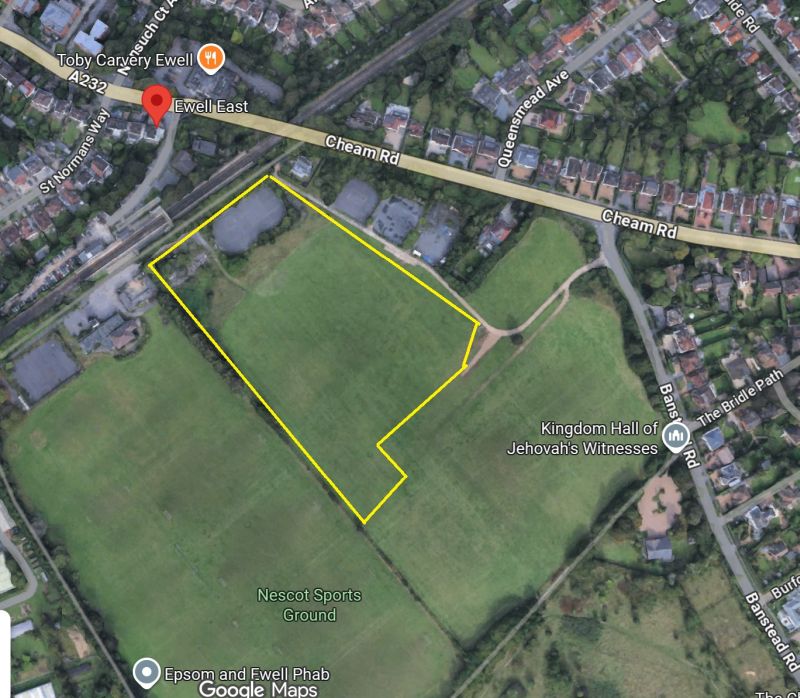

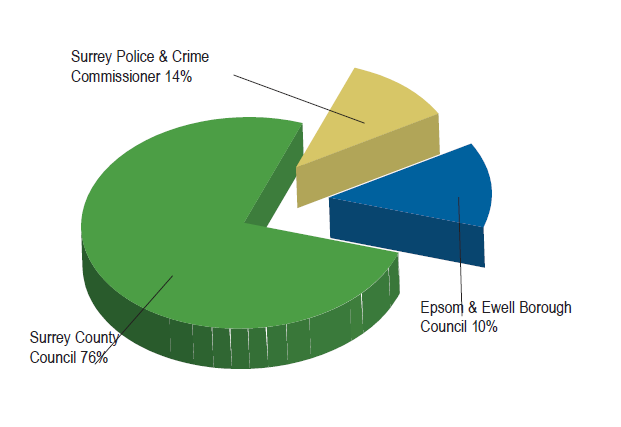

Image: council tax pie chart: EEBC 2022/2023

The budget also outlines the council’s five-year capital investment plan that will deliver more school places and improved school buildings, increased support for children with additional needs, road improvements, big infrastructure projects like in Farnham town centre, the River Thames flood defence scheme, grant funding community projects and increasing recycling capacity across Surrey.

Tim Oliver, Leader of the Council, (Conservative) said: “This budget is about protecting the services that the people of Surrey rely on, while being mindful of the huge pressures household budgets are under at the moment. The rise in the cost of living, inflation and interest rates have all impacted the council as an organisation, as well as our residents. Everything we do has simply become more expensive to deliver. However, we have worked hard over the last five years to ensure our finances are in a solid and stable state.

“We think it is important to only levy the absolute minimum we need to meet increased costs, in order to protect the money in people’s pockets as much as possible. “We are making the decision to face this financial challenge in the fairest way possible, balancing our needs and ambitions with the immediate cost of living impact on our residents.”

The budget will go before a Full Council meeting on Tuesday 7 February to be ratified.

The full details of the proposed 2023/24 budget can be found here.

Notes:

This list shows the Council’s budget plan for next year by each service area, and an indication of how much that is in terms of average Council Tax*.

Adult Social Care – Looking after people with disabilities, severe needs, and as they get older.

£439.7m per year (That is equivalent of £668.66 of annual Council Tax for a Band D property)

Public Service Reform & Public Health – Working closely with our NHS partners to help people live healthier lives and keep them safe and well.

£36.6m per year (That is equivalent of £55.66 of annual Council Tax for a Band D property)

Children, Families & Lifelong Learning – Giving young people the best start in life, with additional care for those who need it and supporting education providers.

£254.8m per year (That is equivalent of £387.48 of annual Council Tax for a Band D property)

Environment, Transport & Infrastructure – Improving our roads and public transport, managing our countryside, and tackling the climate emergency.

£152.8m per year (That is equivalent of £232.37 of annual Council Tax for a Band D property)

Surrey Fire & Rescue Service – Keeping residents safe and responding to emergencies

£38.7m per year (That is equivalent of £58.85 of annual Council Tax for a Band D property)

Customer and Communities – Helping local communities thrive, providing libraries, registrations, customer services and funding grants.

£18.9m per year (That is equivalent of £28.74 of annual Council Tax for a Band D property)

Prosperity, Partnerships and Growth – Working with businesses and other partners to help grow Surrey’s local economy

£1.6m per year (That is equivalent of £2.43 of annual Council Tax for a Band D property)

Communications, Public Affairs & Engagement – Making sure residents are well informed, can access services, and that Surrey’s collective voice is heard.

£2.2m per year (That is equivalent of £3.35 of annual Council Tax for a Band D property)

Resources – Things like Surrey Crisis Fund, school meal provision, administrative support, IT, legal services, and management of council buildings to keep services running smoothly.

£79.3m per year (That is equivalent of £120.59 of annual Council Tax for a Band D property)

Central Income and Expenditure – Putting money into savings to help protect services in future, and repayments on borrowing used for our investment programme

£76.9m per year (That is equivalent of £116.94 of annual Council Tax for a Band D property)

*For illustrative purposes, this represents the total budget split by the Band D council tax value. Some areas are funded by specific restricted grants, which are not reflected here. This is the County Council’s Band D figures only and does not include amounts raised by District & Borough Councils, Surrey Police or Parish Councils.

Surrey County Council news service.

Related Reports:

Senior local Councillor slams Surrey’s budget consultation

Budget Report: More council tax for Epsom and Ewell

Great expectations on Surrey’s tax?