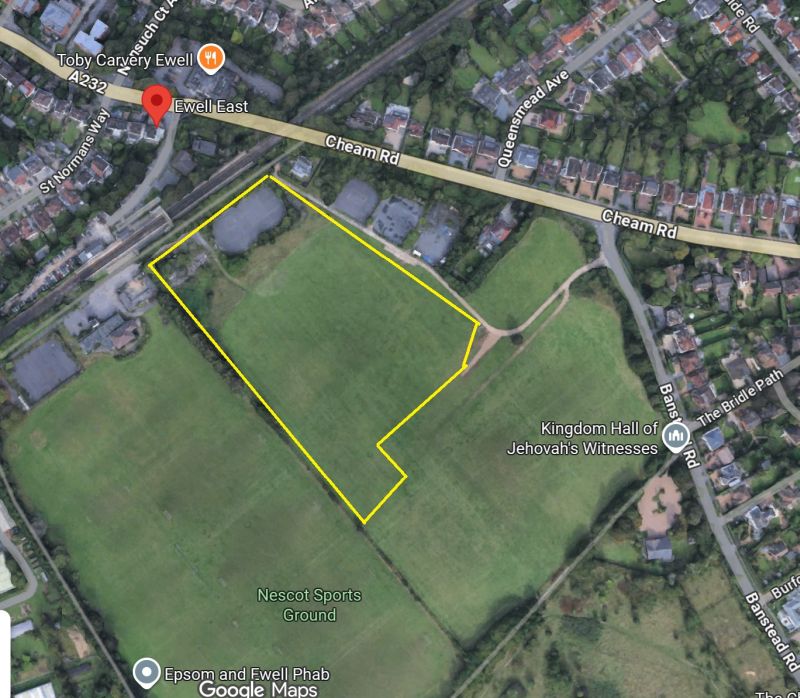

What might local government reorganisation mean for Epsom and Ewell?

As Surrey faces a significant overhaul of its local government structure, residents of Epsom and Ewell are rightfully concerned about the potential financial repercussions. The proposed reorganisation may lead to two unitary authorities that merge the county’s 11 borough and district councils, a move intended to streamline services and reduce administrative costs. However, this consolidation raises pressing questions about fiscal responsibility and the equitable distribution of debt, particularly for boroughs like Epsom and Ewell that have historically maintained prudent financial practices.

The Financial Landscape of Surrey’s Boroughs

The Epsom and Ewell Times has just published three reports detailing the financial woes of three councils within Surrey that are grappling with substantial debts resulting from ambitious investment strategies.

- Woking Borough Council declared effective bankruptcy in 2023, burdened by debts exceeding £2 billion due to failed investments in large-scale projects. The council has since been compelled to implement severe austerity measures, including significant tax increases, service closures, and asset sales.

- Spelthorne Borough Council faces over £1 billion in debt from investments in commercial properties. A recent audit revealed “significant weaknesses” in financial record-keeping, inadequate plans to address looming budget gaps, and concerns over governance and internal culture.

- Guildford Borough Council is confronting a challenging financial future, with projected budget gaps escalating to £5.9 million by 2028/29. The council has acknowledged the need for cost reductions and increased income to manage these pressures.

Epsom and Ewell’s Prudent Financial Management

In contrast, Epsom and Ewell Borough Council has consistently balanced its budgets or been able to use reserves to meet its obligations, demonstrating fiscal discipline and effective financial stewardship. This prudent management has enabled the council to maintain most services and infrastructure without accruing unsustainable debt levels.

The Justice of Debt Redistribution

The proposed reorganisation raises a critical question: Is it just for residents of financially prudent boroughs like Epsom and Ewell to assume responsibility for the substantial debts incurred by other councils? Merging councils into larger unitary authorities could lead to a pooling of assets and liabilities, potentially obliging Epsom and Ewell’s residents to contribute to servicing debts they had no part in accumulating.

This scenario not only challenges principles of fiscal fairness but also risks penalising councils that have exercised sound financial management. It is imperative to consider whether it is equitable for residents to bear the financial burdens resulting from the mismanagement of neighbouring authorities.

Calls for Government Intervention

Recognising the potential injustice, Surrey County Council’s leader, Councillor Tim Oliver, has advocated for central government to write off the significant debts of councils like Woking before proceeding with devolution plans. This approach aims to mitigate the financial risks associated with high debt levels and prevent the unfair distribution of financial burdens across the county. How likely is it that a Labour Government will write off a debt accumulated by Woking under its previous Conservative led Council?

The Path Forward

As discussions about local government reorganisation progress, it is crucial to ensure that any new structures are underpinned by principles of fiscal responsibility and equity. Potential solutions include:

- Debt Segregation: Isolating the debts of heavily indebted councils to prevent them from being transferred to newly formed unitary authorities.

- Government Debt Relief: Advocating for central government intervention to alleviate or write off unsustainable debts, ensuring that the financial missteps of certain councils do not adversely impact the entire county.

- Transparent Financial Assessments: Conducting comprehensive financial evaluations of all councils involved in the reorganisation to inform fair and equitable decision-making.

The proposed reorganisation of Surrey’s local government presents an opportunity to enhance efficiency and service delivery at the cost of Borough based democracy. However, it also necessitates careful consideration of the financial implications for all residents. Epsom and Ewell’s community, having benefited from prudent financial management, should not be unduly burdened by the debts of other councils. It is incumbent upon policymakers to design a reorganisation framework that upholds fiscal justice, ensuring that the residents of Epsom and Ewell are not unfairly disadvantaged in the pursuit of broader administrative reforms.

Related reports:

All change! Epsom and Ewell Borough Council approaching its final stop?

Surrey’s Conservative leader wants to postpone May’s poll reckoning

Tiers to be shed if Epsom and Ewell loses its Borough Council?