Council Finances Under Strain as National Insurance Rises and Reorganisation Looms

A new report from the Local Government Information Unit (LGIU) has raised serious concerns about the financial sustainability of councils across England, including those in Surrey. The 2025 State of Local Government Finance report reveals that fewer than one in ten senior council officials are confident in the future stability of local government finances. With spiralling service demands and National Insurance Contribution (NIC) rises adding further pressure, councils are facing a perilous financial future.

The government’s plans for local government reorganisation are also causing alarm, with fewer than one in four council officials believing it will improve council finances. Only one in ten feel they have been properly involved in the process, while just one in five think the proposed timescales are realistic. The lack of clarity around reorganisation has left many councils uncertain about their financial future.

The LGIU report warns that 6% of councils could be effectively bankrupt by the end of this financial year unless urgent reforms are made. Without significant changes, that figure could rise to 35% of councils by 2030, meaning over 100 local authorities may be forced to issue Section 114 notices – the legal declaration of financial failure.

Surrey Councils at Risk

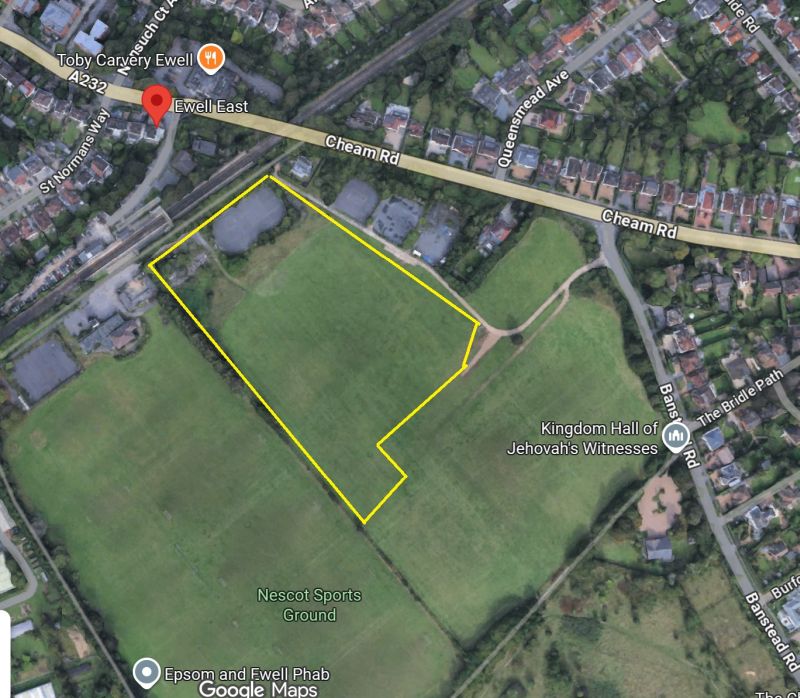

Surrey’s councils are already feeling the strain. Epsom and Ewell Borough Council recently admitted that it faces severe financial challenges, while neighbouring authorities such as Surrey County Council and Guildford Borough Council have been forced to make significant budget cuts. Just last year, Woking Borough Council issued a Section 114 notice, effectively declaring bankruptcy due to unsustainable borrowing and financial mismanagement.

There are concerns over how the government’s reorganisation plans might impact Epsom and Ewell. If plans for widespread restructuring go ahead, smaller councils like Epsom and Ewell could face further financial uncertainty and potential absorption into larger authorities, reducing local accountability.

Tax Rises, Cuts, and Borrowing

To plug the financial gap, councils across the country – including those in Surrey – are turning to drastic measures. The LGIU survey found that:

- 94% of councils plan to increase council tax

- 88% will raise fees and charges for services

- 22% intend to borrow more money

- 63% will reduce spending on services

- 56% will use their financial reserves to balance the books

For many councils, this will be the second year in a row of raiding their reserves – a short-term fix that is not sustainable.

In Surrey, these pressures have already led to service cutbacks. Epsom and Ewell Borough Council has warned that further reductions in public services may be necessary, while Surrey County Council is grappling with a funding gap running into tens of millions of pounds. The rising demand for temporary accommodation, adult social care, and children’s services continues to place unbearable strain on local budgets.

Calls for Urgent Reform

The LGIU report highlights near-total consensus among council leaders on the need for major financial reforms. A massive 92% of respondents support the introduction of multi-year financial settlements, which would allow councils to plan their budgets with greater certainty. Additionally, 77% of officials back council tax reform, while around 75% want more fiscal powers, such as the ability to introduce tourism taxes or local sales taxes, as seen in other countries.

Jonathan Carr-West, Chief Executive of LGIU, said:

“At the end of last year, the government made clear that devolution, reform of the local government finance system, and public sector reform should go hand in hand. Our survey shows in stark detail that they are not currently aligned in any meaningful way.

While there is some optimism about multi-year settlements, councils are deeply concerned about the impact of reorganisation and NIC increases on already overstretched budgets. Councils do not believe they have been given sufficient clarity, involvement, or time to prepare for these changes.”

The LGIU has called for the government to introduce a standing commission to oversee local government reorganisation and for councils to be given greater financial powers. Without urgent reform, councils across England – including in Surrey – face an increasingly bleak financial future.

Related reports:

Epsom & Ewell Borough Council: Financial Crisis or Manageable Deficit?

Ex-Council Officers under investigation for Woking’s £2 billion debt

Examination of a Surrey Borough’s 2nd highest UK debt