A coalition of five councils has today (Thursday 16 February) launched a Judicial Review to challenge Transport for London (TfL) and the Mayor of London’s decision to expand the Ultra Low Emission Zone (ULEZ) to outer London boroughs.

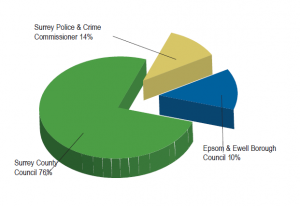

The London boroughs of Bexley, Bromley, Harrow and Hillingdon and Surrey County Council have brought legal action following TfL’s announcement in November 2022 that it would push on with proposals to expand the scheme in August 2023 despite strong opposition from across outer London and beyond including concerns over how it is being delivered.

The coalition will challenge the expansion in the High Court on five grounds:

1. Failure to comply with relevant statutory requirements

2. Unlawful failure to consider expected compliance rates in outer London

3. The proposed scrappage scheme was not consulted upon

4. Failure to carry out any cost benefit analysis

5. Inadequate consultation and/or apparent predetermination arising from the conduct of the consultation

Cllr Tim Oliver, Leader of Surrey County Council, said: “We are committed to delivering a greener future, but it must be done in a practical and sustainable way. We are dismayed at the lack of discussion or consideration given to these proposals by the Mayor of London. The impact on many Surrey residents and businesses will be significant and we will not stand by and watch that happen with no mitigations offered from the Mayor.

“To date, our requests for due consideration to be given to these mitigations have not been acknowledged, let alone acted upon. It’s disappointing that we, along with other local authorities, have to resort to legal proceedings to try and bring the Mayor of London to the table, but we have no choice but to do so.”

Cllr Ian Edwards, Leader of Hillingdon Council, said: “Our position has remained unchanged from when TfL’s plans were first mooted – ULEZ is the wrong solution in outer London as it will have negligible or nil impact on air quality but will cause significant social and economic harm to our residents. We shared this view in our response to the TfL consultation last summer and we’ve said it since when the plans were confirmed in November. Now, we’ll say it in the courts.

“We believe Sadiq Khan’s decision to impose this scheme on outer London boroughs is unlawful – his spending nearly £260 million of public money without any cost benefit analysis. Hillingdon, and the other coalition local authorities wouldn’t dream of making decisions in this fashion.

“The predominant effect of ULEZ expansion will be to financially cripple already struggling households, further isolate the elderly and harm our local economy with negligible or no improvement to air quality. Investment in improved transport links – on a par with those in areas within the existing ULEZ – is the better way to reduce car use in Hillingdon.”

Cllr Baroness O’Neill of Bexley OBE, Leader of the London Borough of Bexley, said: “We have been clear from the start that we believe air quality is important but that ULEZ is the wrong solution. By wanting to expand ULEZ to outer London boroughs it appears that the Mayor’s message is you can pollute as long as you can afford the £12.50.

“We believe he should give the monies that he has allocated to ULEZ to the boroughs who actually understand outer London and the transport connectivity problems our residents face to come up with innovative solutions that will deliver better, more practical results.

“We are also very concerned about the mental wellbeing of our residents who we know are already anxious about the installation of ULEZ and the very real prospect that they won’t be able to use their cars to get to work, visit relatives and friends, shop or attend health appointments.

“We are standing up for our residents who have given us a clear message of what they think of his plan.”

Cllr Colin Smith, Leader of Bromley Council, said: “We have been sounding the alarm about Mayor Khan’s attempted tax raid on the outer ‘London’ suburbs for many months now. The fundamental truth as to his true intention is now increasingly plain for all to see.

“In Bromley, this socially regressive tax directly threatens jobs, the viability and availability of small businesses, and causing significant damage to vital care networks, as well as creating a completely avoidable spike in the cost of living locally, at a time when some households are already struggling to make ends meet.

“To attempt to do all of this under cover of a false health scare over air quality, when the Mayor’s own research confirms that Bromley has the second cleanest air in London, also, that extending ULEZ to the boundaries of the M25 will make no discernible difference to air quality locally, is frankly unforgivable.

“The upset, pain and anxiety this has caused locally is immense, which is why, even at this late stage, I once again call on the Mayor to withdraw this spiteful proposal.”

The five grounds and a summary of each:

1.Failure to comply with relevant statutory requirements

Schedule 23 to the Greater London Authority Act 1999 governs the making of “charging schemes.” The Mayor decided to extend ULEZ by varying the existing scheme (which applies to inner London). Although Schedule 23 does permit a charging scheme to be varied, the proposed changes are so wide ranging that they amount to a whole new charging scheme which cannot be introduced by way of a variation. In addition, Schedule 23 contains procedural safeguards in the making of a charging scheme which have not been followed by the Mayor.

2. Unlawful failure to consider expected compliance rates in outer London

The Mayor’s failure to provide any meaningful information as to how he expects an instant 91 per cent compliance rate was unfair, and specifically, the Mayor did not respond to Hillingdon’s consultation response that the compliance assumptions “were not fit for purpose.” In addition, the consultation documents were unclear and confusing and prevented consultees from making proper responses.

3. The proposed scrappage scheme was not consulted upon

In making his decision to extend ULEZ the Mayor committed to a scrappage scheme costing £110 million. Details of the scrappage scheme only become available following his decision and were not subject to prior consultation. In particular, the Mayor’s decision to only offer the scrappage scheme to those residing in London was not consulted upon, although this was highlighted in the consultation response from Surrey County Council. Given the importance of the scrappage scheme to the Mayor’s decision, a consultation on the scrappage scheme should have taken place.

4. Failure to carry out any cost benefit analysis

Treasury Guidance recommends a cost benefit analysis where a policy decision requires the use of “significant new” public money. No such analysis was undertaken by the Mayor and no explanation given as to why one was inappropriate. Given that the implementation cost is estimated at £160 million and that the Mayor has introduced a separate £110 million scrappage scheme, and that the expansion is expected to generate a net operating surplus of £200 million in the first full year of operation, his decision clearly involves “significant new” public money.

5. Inadequate consultation and/or apparent predetermination arising from the conduct of the consultation

The consultation exercise contained 15 questions with drop-down answers, only one of which sought to address the question of whether the expansion should go ahead. In addition, following disclosure by the Greater London Authority (GLA) of background consultation information to the GLA Conservatives, it appears that a number of “organised responses” were excluded by TfL particularly those which opposed the expansion. This took place during the consultation and the way in which this happened suggests that the Mayor had predetermination.

Related reports:

A sign of no signs to come on ULEZ?

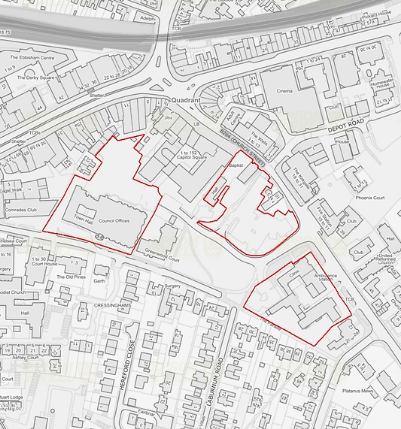

ULEZ will come to Epsom and Ewell borders

Yet more on ULEZ….

More on Epsom and Ewell and Surrey and ULEZ

Council’s last minute opposition to ULEZ extension.